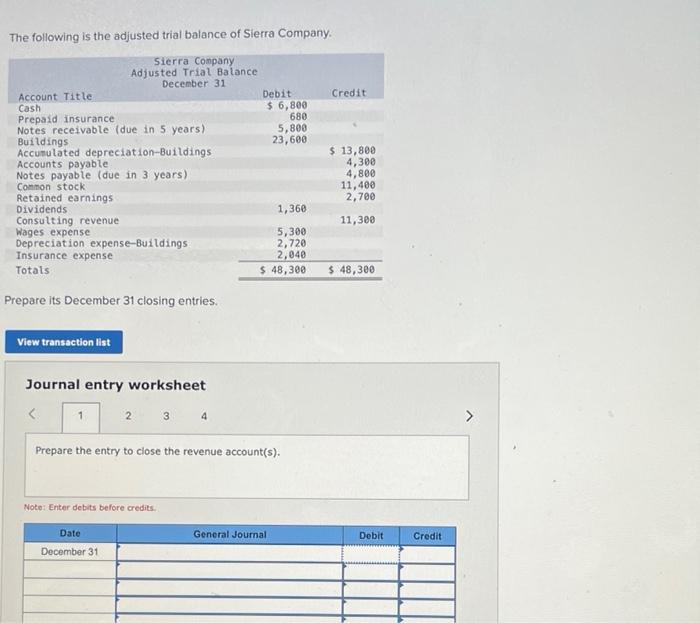

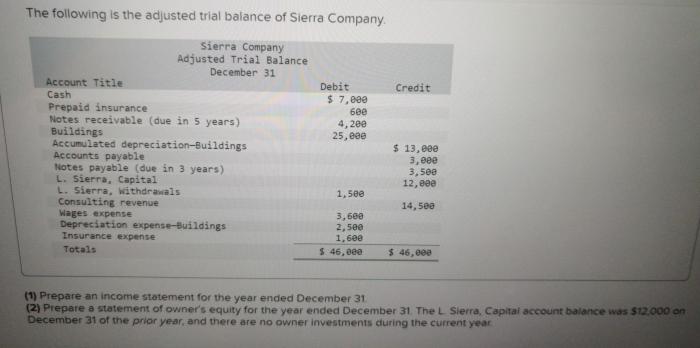

The following is the adjusted trial balance of sierra company. – The following is the adjusted trial balance of Sierra Company, a document that serves as a cornerstone of financial reporting. This guide delves into the purpose, significance, and intricacies of the adjusted trial balance, providing a comprehensive understanding of its role in the accounting process.

An adjusted trial balance is a financial statement that summarizes the balances of all accounts after adjustments have been made to correct for errors and omissions in the unadjusted trial balance. These adjustments ensure that the financial statements accurately reflect the company’s financial position and performance.

The Adjusted Trial Balance of Sierra Company: The Following Is The Adjusted Trial Balance Of Sierra Company.

The adjusted trial balance is a financial statement that presents the balances of all accounts after adjustments have been made to the unadjusted trial balance. It is used to ensure that the balances in the financial statements are accurate and up-to-date.

The adjusted trial balance is prepared by making the following adjustments to the unadjusted trial balance:

- Accrued revenues: These are revenues that have been earned but not yet recorded.

- Deferred revenues: These are revenues that have been received but not yet earned.

- Accrued expenses: These are expenses that have been incurred but not yet recorded.

- Deferred expenses: These are expenses that have been paid but not yet incurred.

Once these adjustments have been made, the adjusted trial balance will show the balances of all accounts as of a specific date. This information is then used to prepare the financial statements.

Understanding the Adjustments

The adjustments that are made to the unadjusted trial balance are necessary to ensure that the financial statements are accurate and up-to-date. These adjustments are based on the accrual accounting principle, which requires that revenues and expenses be recorded in the period in which they are earned or incurred, regardless of when cash is received or paid.

The following are some of the most common types of adjustments that are made:

- Accrued revenues: These are revenues that have been earned but not yet recorded. For example, if a company provides services to a customer in December but does not invoice the customer until January, the revenue should be accrued in December.

- Deferred revenues: These are revenues that have been received but not yet earned. For example, if a company receives a payment for a subscription in advance, the revenue should be deferred until the subscription period has expired.

- Accrued expenses: These are expenses that have been incurred but not yet recorded. For example, if a company uses supplies in December but does not pay for them until January, the expense should be accrued in December.

- Deferred expenses: These are expenses that have been paid but not yet incurred. For example, if a company prepays insurance for a year, the expense should be deferred over the year.

Preparing the Adjusted Trial Balance

The adjusted trial balance is prepared by making the following adjustments to the unadjusted trial balance:

- Identify the accounts that need to be adjusted.

- Determine the amount of the adjustment.

- Make the adjustment to the unadjusted trial balance.

Once the adjustments have been made, the adjusted trial balance will show the balances of all accounts as of a specific date. This information is then used to prepare the financial statements.

Using the Adjusted Trial Balance

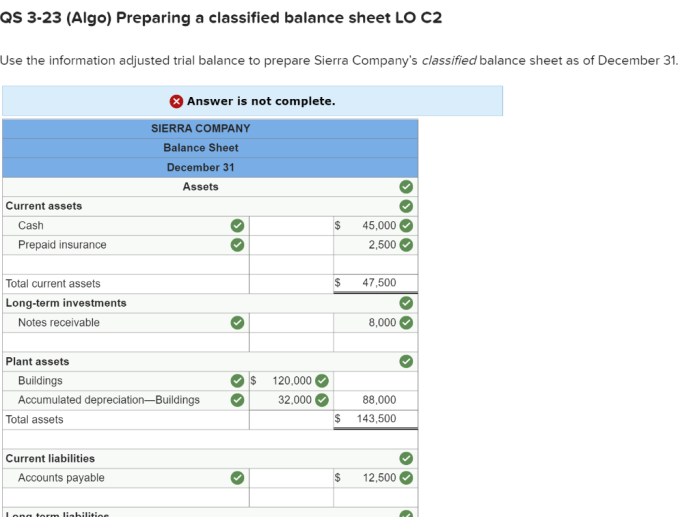

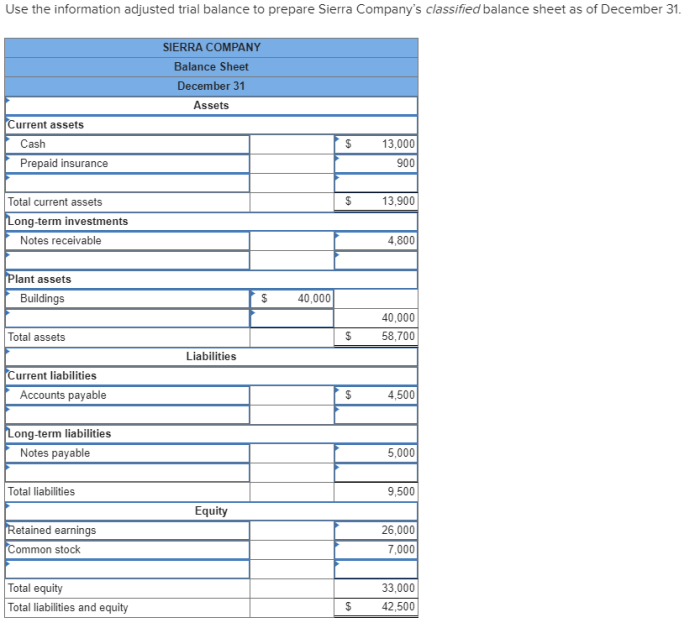

The adjusted trial balance is used in the financial reporting process to prepare the financial statements. The financial statements are used by investors, creditors, and other stakeholders to make decisions about the company.

The adjusted trial balance can also be used for decision-making and analysis. For example, the adjusted trial balance can be used to:

- Identify trends in the company’s financial performance.

- Evaluate the company’s financial health.

- Make decisions about the company’s future.

Question & Answer Hub

What is the purpose of an adjusted trial balance?

The purpose of an adjusted trial balance is to provide a corrected and updated summary of account balances after adjustments have been made to rectify errors and omissions in the unadjusted trial balance.

What are the key differences between an unadjusted and an adjusted trial balance?

An unadjusted trial balance does not include adjustments, while an adjusted trial balance incorporates adjustments to correct for errors and omissions, resulting in a more accurate representation of the company’s financial position.

How is the adjusted trial balance used in the financial reporting process?

The adjusted trial balance is used as the basis for preparing financial statements, such as the income statement, balance sheet, and statement of cash flows.