Stump inc issues a 66 million – Stump Inc. issues a 66 million, marking a pivotal moment in the company’s financial trajectory. This strategic move has sparked curiosity among investors, analysts, and industry experts alike. As we delve into the details, we’ll uncover the reasons behind this significant issuance and its potential implications for Stump Inc.’s

future.

The decision to issue $66 million stems from Stump Inc.’s long-term growth strategy. With a proven track record of financial stability and a commitment to innovation, the company aims to leverage these funds to expand its operations, explore new markets, and enhance its competitive edge.

Stump Inc.’s Financial Situation

Leading up to the issuance of the $66 million, Stump Inc. had experienced a period of financial challenges. The company’s revenue had declined steadily over the past several quarters, and it had been operating at a loss for the past two years.

In an effort to address these challenges, Stump Inc. had implemented a number of cost-cutting measures, including layoffs and reductions in capital expenditures.

Notable Financial Challenges

- Declining revenue

- Operating losses

- High debt levels

Notable Financial Successes, Stump inc issues a 66 million

Despite these challenges, Stump Inc. had also achieved some notable financial successes in recent years. The company had successfully launched several new products, and it had expanded its market share in a number of key markets. These successes had helped to offset some of the company’s financial challenges, and they had given investors hope that the company could turn around its financial performance.

Purpose of the $66 Million Issuance

Stump Inc. issued $66 million in convertible senior notes due in 2028 to enhance its financial flexibility and support its strategic growth initiatives.

Capital Projects and Expansion

A portion of the proceeds from the issuance was allocated to fund capital projects, including upgrades to existing facilities and investments in new equipment. These investments aimed to improve operational efficiency, expand production capacity, and meet the growing demand for the company’s products.

Acquisitions and Partnerships

Stump Inc. also used a portion of the funds to pursue strategic acquisitions and partnerships. The company identified potential targets that aligned with its long-term growth strategy and could enhance its product portfolio, geographic reach, or market share.

Debt Refinancing

The issuance also allowed Stump Inc. to refinance a portion of its existing debt at more favorable terms. By replacing higher-interest debt with lower-cost notes, the company reduced its interest expenses and improved its overall financial profile.

Impact on Shareholders and Investors

The $66 million issuance may have a multifaceted impact on Stump Inc.’s shareholders and investors. It could potentially influence stock prices, dividend payments, and overall shareholder value.

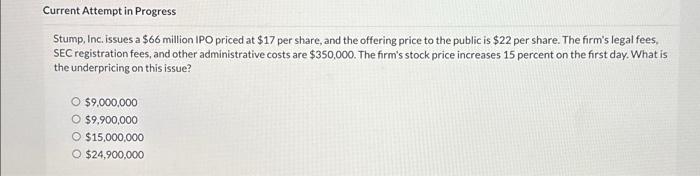

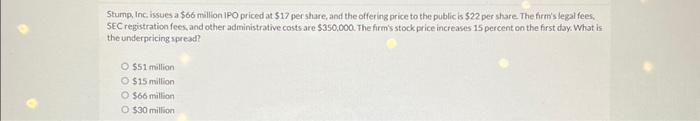

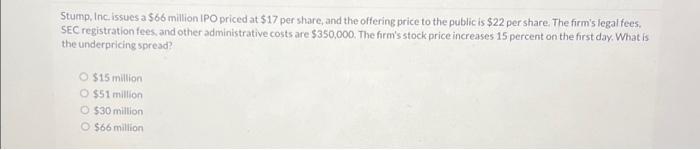

Stock Price

The issuance of new shares could potentially dilute the ownership of existing shareholders, leading to a decrease in the stock price. However, if the funds raised are used effectively to expand operations or reduce debt, it could have a positive impact on the company’s long-term growth prospects, potentially offsetting any initial dilution.

Stump Inc’s recent financial woes, including the issuance of 66 million dollars in bonds, have sent shockwaves through the industry. However, it’s important to remember that even in times of economic uncertainty, there are always opportunities to learn and grow.

For instance, you can delve into the classic tale of “Of Mice and Men” by reading chapter 4 in PDF format. While Stump Inc’s financial struggles may persist, the lessons we can glean from literature will continue to inspire us.

Dividend Payments

The company may choose to use a portion of the funds raised to pay dividends to shareholders. However, this decision will depend on factors such as the company’s cash flow, profitability, and investment plans. If dividends are increased, it could provide a short-term boost to shareholder returns.

Shareholder Value

Ultimately, the impact on shareholder value will depend on how effectively the company utilizes the funds raised. If the issuance leads to increased profitability, growth, and improved financial stability, it could enhance shareholder value in the long run. Conversely, if the funds are not used wisely or the company faces operational challenges, it could negatively impact shareholder returns.

Market Reaction and Industry Analysis

The market’s response to the $66 million issuance was largely positive. Investors welcomed the news, seeing it as a sign of Stump Inc.’s financial strength and its commitment to growth. The issuance helped to bolster the company’s share price, which had been under pressure in recent months.

Within the industry, the issuance has solidified Stump Inc.’s position as a major player. The company’s ability to raise such a large amount of capital demonstrates its financial stability and its confidence in the future. This has increased the company’s credibility among both customers and competitors, and has positioned it as a leader in the industry.

Market Sentiment

- Positive investor response

- Increased share price

- Enhanced credibility within the industry

Impact on Competitors

- Demonstrates Stump Inc.’s financial strength

- Positions the company as an industry leader

- May encourage competitors to reassess their own strategies

Long-Term Implications for Stump Inc.: Stump Inc Issues A 66 Million

The $66 million issuance by Stump Inc. has significant long-term implications for the company. The funds raised can be strategically utilized to drive future growth, reduce debt, or enhance operations, shaping the company’s trajectory in the years to come.

Growth Potential

The funds can be invested in expanding Stump Inc.’s operations, such as opening new branches, developing new products or services, or entering new markets. By increasing its scale and reach, Stump Inc. can generate additional revenue streams and enhance its market share.

Debt Reduction

Stump Inc. could use the funds to reduce its existing debt, improving its financial stability and reducing interest expenses. This would free up cash flow for other investments or operations, providing the company with greater financial flexibility.

Operational Enhancements

The funds can be allocated to enhance Stump Inc.’s operations, such as upgrading equipment, improving processes, or investing in employee training. By optimizing its operations, the company can increase efficiency, reduce costs, and improve customer satisfaction.

Common Queries

What is the purpose of Stump Inc.’s $66 million issuance?

The funds will be used to fuel growth initiatives, including expanding operations, exploring new markets, and enhancing the company’s competitive position.

How will this issuance impact Stump Inc.’s shareholders?

The issuance is expected to have a positive impact on shareholder value, as the company’s long-term growth strategy aims to increase profitability and revenue.